Are Heyworth School District taxes too high?

In the past year, I’ve seen at least one Facebook post in the Heyworth groups questioning why property taxes are so high and still going up. Since the School District makes up over 66% of my tax bill, I want to focus on that taxing body.

We’ve seen in the Pantagraph how Unit 5 School District is significantly increasing their tax rate predominantly due to changes in how the retail landscape is changing. At a recent School Board meeting for approving the next years levy one of the board members asked how the Heyworth tax rate compares to districts around us. As a disclaimer to the data presented here, this research is a very lopsided look at just the tax rate, and there are many more aspects that determine if a district is successful in providing the value expected by taxpayers.

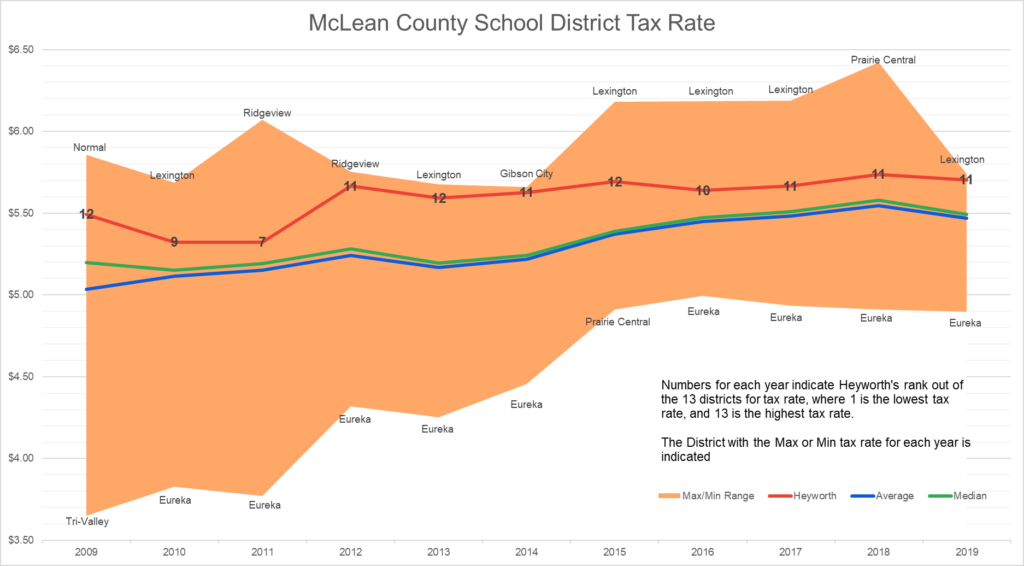

Let’s do a comparison of tax rates of the 13 school districts in the county and trends. The orange area shows the range of taxes across all districts in the county, from the lowest tax rate at $3.65, to the highest at $6.42. The district with the highest/lowest rate for that year is named. Heyworth’s position in the range is the red line. The average and median tax rates are blue and green. As we can see, Heyworth is generally a higher tax rate than median, but never the highest.

It’s interesting to see how in general, tax rates are going up. But notice the different between the low and high tax rates is getting narrower, so districts seem to be following each others lead in normalizing the tax rate in the mid $5 .

In 2019 Heyworth requested $0.21 or 4% more than the median rate. On a property valued by the county assessor for $200k, this is a cost of $140/year in extra taxes over the median rate.

If you want the lowest tax rate in our county, Eureka wins pretty consistently. In 2019, the same $200k property would have paid $540 less compared to the Heyworth district.

The Heyworth board at the December meeting approved a new tax levy that is expected to drop the tax rate set by the school from $5.70459 to $5.69 or .18%. This does not mean your taxes will go down next year. In fact, with that rate reduction, the school is still expecting to collect an additional $200k in revenue this next year. The County Assessor told the school they expect to increase property values approximately 2.9%. The end result for our $200k sample property is you will be paying an additional $100 in taxes to the school district.

The main reason given by Superintendent Taylor for why the district needs the extra $200k in revenue is because of the new contract with our teachers. The district accounting auditor during their review of the annual financial statement also called out possible increased operating costs due to the new gym.

Both of these are very good reasons for the increases. We need to keep and attract excellent teachers and staff amid an environment in which teachers are becoming more scarce and continue to meet community needs with new, efficient buildings that will reduce operating costs in the long run. I feel the taxes we pay to support our school are more than reasonable when our schools are recognized as being in the top 10% performing schools in our state.

Good article Josh. I like seeing facts broke down in an easy to view format.

Thank you for the time and effort put towards this.